Giving you the Power of Knowledge

Food for thought

Some people chose to do a little more research on their own. Maybe they want to think about it, or discuss their interest with a spouse or partner, but they struggle to find the applicable material on the internet for more information that isn’t just another opinion from a financial advisor.

To save you time and headache, we’ve compiled a collection of material on this page about Annuities and the Lifetime Income Retirement Plan (L-IRA) for you to review, that will help to strengthen your understanding and gain clarity.

This is where you’ll find Videos, White Papers and Study Data from the Nobel Prize Laureate Professors about their retirement research, and the outlook data of costs for Health Care Services in retirement.

We’re pretty darn sure that once you go through this assorted material in addition to our website content, you’ll have what we originally promised… enough information to make an educated decision on how Annuities can work for you.

Residing in Assisted Living

The data shows that more than 70% of people will spend at least 1 to 2 years of their retirement in an Assisted Living Facility. Costs fluctuate depending on where you reside at the time and the level of requested services, but the national average is currently between $5,000 – $6,500 per month (x12 mo’s = $60,000 – $78,000 annually). AARP and AssistedLiving.org report statistics that show 30% of residents are between age 75 and 84, with 50% at least 85 years old.

Imagine what the cost will be 20 years from now when you’re 85… wow! Experts predict 2x the price! Medicare insurance doesn’t cover this expense and most people don’t have Long Term Care insurance either. This big expense can see your savings dramatically reduced and shorten the time it will last.

Solution: an included benefit of a Fixed Index Annuity, can double your income payment that can go towards paying for the expense of residing in an ALF.

There’s nothing that substitutes for a Video directly from the Source

Documents

Clicking item opens new window.

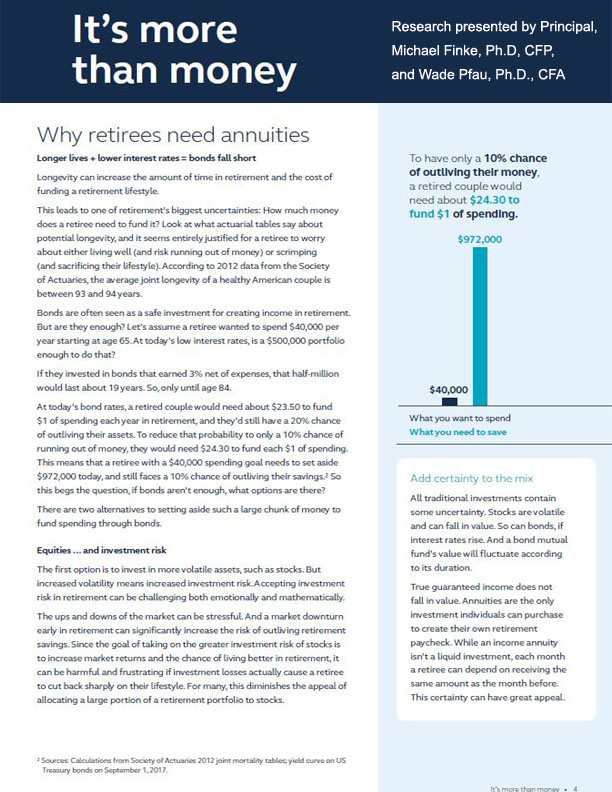

Research studies from

Expert Retirement Economists

Michael Finke & Wade Pfau

“In today’s economic environment, where returns for safe capital are minuscule, Fixed Index Annuities can be a great alternative to other financial instruments. Remember, you have to turn your savings into income and the Fixed Index Annuity cannot be beat for a safe and secure Retirement.”

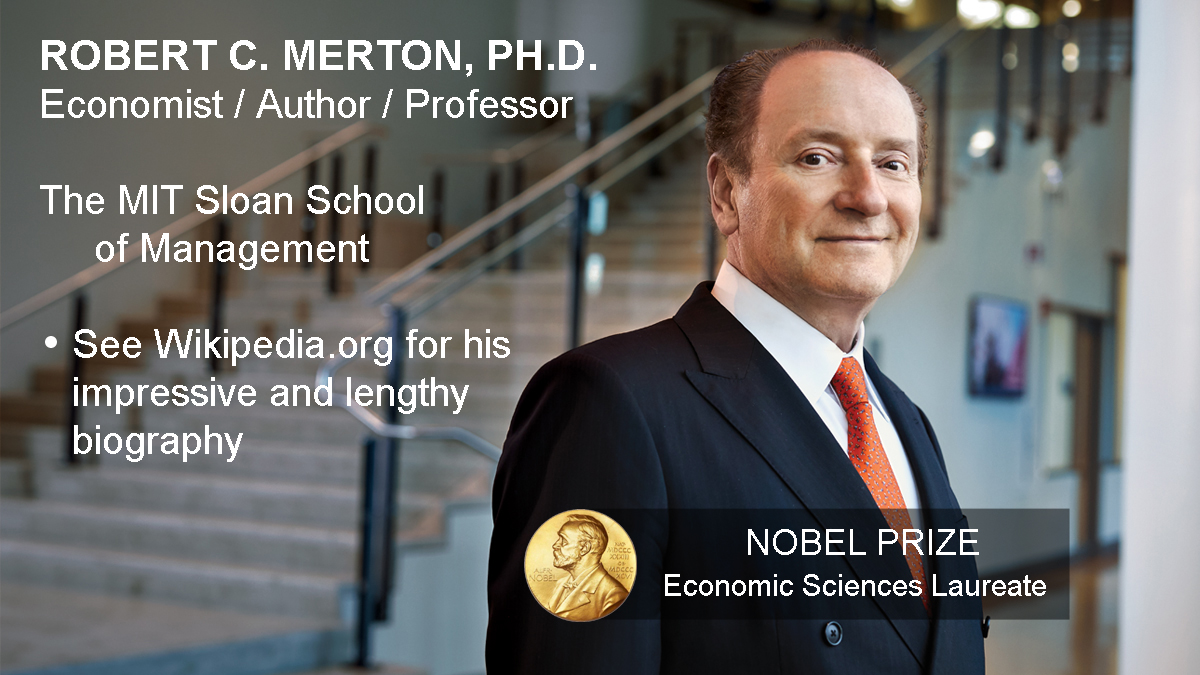

Robert C. Merton

“Annuities are central to any Retirement Plan. It’s a helpful tool in that it provides peace-of-mind for policy owners who want to maintain their standard of living throughout their Golden Years. The key feature of any Life Annuity is their protection against inflation when payments increase in tandem with the rising costs of living.”

Olivia Mitchell

“What we know from my research, is that Index Annuities outperform the S&P 500 roughly 70% of the time, and a 50/50 mix of stocks & bonds about 79% of the time, over any 5-year period. Index Annuites are definitely a really great place for one’s Retirement Savings and financial security.”

When compared to the risks and income uncertainty of other savings vehicles, it is crystal clear that the Lifetime Income Retirement Account (L-IRA) with Fixed Index Annuities, is the smartest and best choice for your financial security in retirement.

We invite you to call us today for a neighborly conversation about what you want for your retirement.

Notices

COPYRIGHT © 2025

ALL RIGHTS RESERVED

American Financial Security

www.largestincome.com

Contact Info

(727)282-5535

afs@usa.com

3030 N. Rocky Point Dr. W.

Tampa, FL 33607

Quick Links